Master Series C+ funding (2025): $50M median round (up 67% from 2020), $100M-$250M valuation, founder secondary sales ($2-5M typical), bridge financing strategies, late-stage investor types, M&A preparation, global expansion, path to IPO or acquisition. Table of Contents What is Series…

Accelerator vs Direct VC: Should You Apply for YC or Sequoia?

Master the accelerator vs direct VC decision (2025): Y Combinator vs Sequoia vs Techstars comparison, pros/cons analysis, time commitment (3-6 months), equity terms (5-10%), network value, decision framework for founders at different stages. Table of Contents The Choice That Defines…

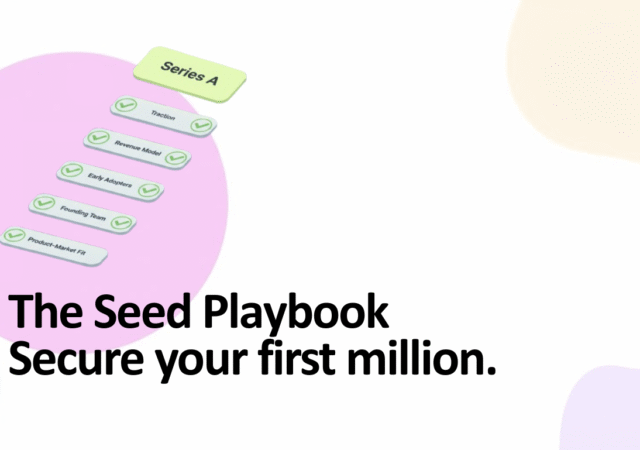

Series A Checklist: When You’re Ready to Scale

Master Series A readiness (2025): Key metrics to hit ($1M-$3M ARR, 10-20% monthly growth), team structure requirements (15-25 people), product-market fit validation, unit economics benchmarks, cap table optimization, term sheet expectations, due diligence preparation. Table of Contents What is Series…

Seed Round Strategy: $500K-$2M Fundraising Playbook

Master seed round fundraising (2025): 12-week preparation timeline, target investor identification, multi-tranche SAFE strategy, pitching techniques, closing negotiations, cap table planning, avoiding the Series A crunch with 18+ months runway. Table of Contents Why Seed Rounds Matter More Than Ever…

Finding the Right Investor: Angels, VCs, Syndicates, Accelerators

Master investor selection (2025): Angel investors vs VCs with check sizes and time commitment, syndicate platforms (AngelList, Wefunder, Republic), accelerator vs incubator programs, what each investor type values, decision criteria. Table of Contents Why Investor Fit Matters More Than Just…

The Pitch Narrative: Storytelling That Moves Investors

Master pitch storytelling (2025): Hero’s journey framework applied to startups, founder origin story that resonates with investors, problem-solution narrative structure, emotional connection psychology, why founders matter more than ideas, real examples from Airbnb Slack Dropbox. Table of Contents Why Storytelling…

Pitch Deck – Slide 9-12 – Financials, Ask & Use of Funds, Vision: Closing Strong

Master the final slides of your pitch deck (2025): Financial projections for 3-5 year models, fundraising ask amount and timing, use of funds allocation breakdown, cap table and dilution (12-20% seed standard), vision statement that inspires, real examples closing successfully.…

Pitch Deck – Slide 6-8 – Business Model, Traction, Team: The Money Slides

Master slides 6-8 of your pitch deck (2025): Revenue model with unit economics, traction metrics (MRR, CAC, LTV), team credibility signals, real examples from Airbnb Stripe Slack, how investors evaluate founders, proof points that close deals, Series A vs seed…

Pitch Deck – Slide 1 – The Hook: Your Opening Must Be Killer

Complete guide to the pitch deck opening slide 2025: 7-second first impression window, company name + logo + tagline formula, value proposition in 8-12 words, design principles, real examples from Airbnb (Book rooms with locals), Dutchie (10% of all legal…

Pitch Deck 101: The 12-Slide Template Every Investor Expects

Complete pitch deck guide 2025: 12-slide template structure, narrative flow, what investors actually expect on each slide, slide-by-slide breakdown with examples, common mistakes, real case studies (Airbnb raised $24.7M, Buffer $480K seed, Dropbox $1.2M seed with 3 co-founders), best practices…