Complete vesting schedule guide 2025: 4-year vesting with 1-year cliff is 100% industry standard. Cliff mechanics (0% months 1-12, 25% cliff at month 12, then 1/36 monthly), founder leaves before cliff = forfeits all equity, acceleration clauses (double-trigger vs single-trigger), unvested share treatment, negotiation tactics.

Table of Contents

- What Is Vesting? (Core Concept)

- The 4-Year / 1-Year Cliff (Industry Standard)

- Cliff Mechanics: Why Month 12 Matters

- Founder Vesting: Restricted Stock & 83(b)

- Employee Vesting: Stock Options & RSUs

- Acceleration Clauses: Double-Trigger vs Single-Trigger

- Bad Leaver Clauses & Forfeiture

- Negotiating Vesting: What to Push For

What Is Vesting? (Core Concept)

Vesting is a legal mechanism that converts equity from a promise to reality over time. You don’t own all your shares on day 1. You earn them gradually by staying and building.

The Core Problem Vesting Solves

- Without vesting: Co-founder A and B split equity 50-50 on day 1. Co-founder B leaves after 6 months. They walk away with 50% of the company despite minimal contribution. Unfair

- With vesting: Co-founder A and B split equity 50-50 but vesting over 4 years with 1-year cliff. Co-founder B leaves after 6 months. They get 0% of their equity (forfeited). Co-founder A stays and earns their equity gradually. Fair

Three Types of Vesting

Type 1: Time-Based Vesting (Most Common)

- How it works: Equity vests on a schedule based on time served (months/years)

- Example: 4-year vesting = vests 1/48 per month (or ~0.2% per month)

- Used for: Founders, employees, advisors

Type 2: Performance-Based Vesting (Rare)

- How it works: Equity vests when company hits milestones (revenue targets, product launch, ARR goals)

- Example: “1% vests when company hits ₹1Cr ARR”

- Used for: Advisors, consultants. Risky for employees

Type 3: Hybrid (Time + Performance)

- How it works: 50% vests on time, 50% vests on performance milestones

- Used for: Senior hires (VP level). Rare

Why Vesting Matters (The Stakes)

- For founders: Protects company if co-founder leaves early. Prevents cap table dysfunction

- For employees: Signals company is well-governed. VCs won’t invest in startups without founder vesting in place

- For retention: Vesting schedule is your retention mechanism. Early departure = you lose unvested equity. Incentivizes staying

- For fairness: Equity is earned, not gifted. Aligns incentives

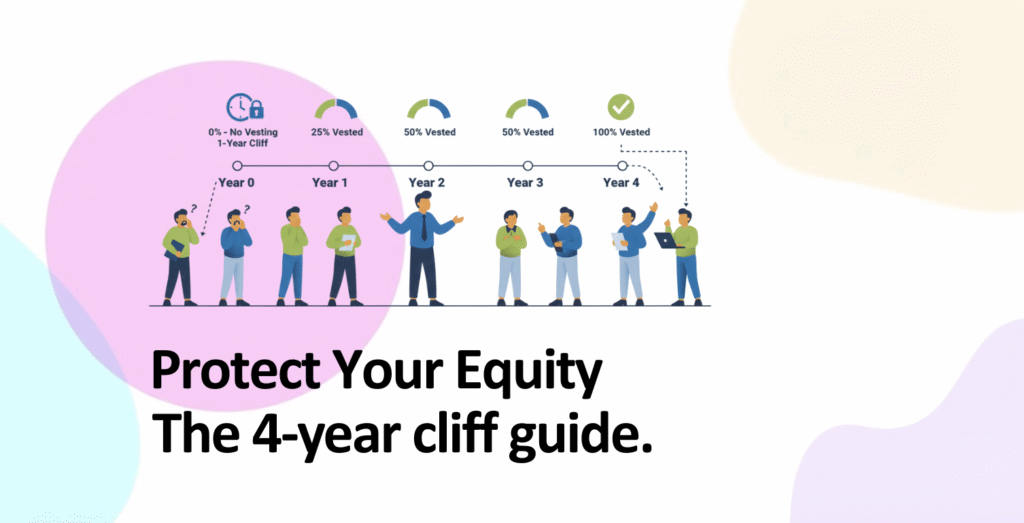

The 4-Year / 1-Year Cliff (Industry Standard)

95%+ of startups use 4-year vesting with 1-year cliff. It’s the global standard. Anything different raises questions from VCs.

What 4/1 Means (Simplified)

- 4 years: Total vesting period is 48 months. After 48 months, 100% of equity is vested

- 1-year cliff: During months 1-12, ZERO equity vests. Nothing. At month 12, 25% vests at once (the “cliff”). Then remaining 75% vests monthly over 36 more months

- Monthly vesting after cliff: Remaining 75% ÷ 36 months = 2.08% per month (approximately 1/36 of total)

The Vesting Timeline (Visual Example)

| Time Period | % Vested | What Happens | If You Leave Now |

|---|---|---|---|

| Month 1-11 | 0% | Cliff period. No vesting yet | You get 0%. Lose all equity |

| Month 12 (1-year mark) | 25% | Cliff vests at once. 25% becomes yours | You keep 25%, lose 75% |

| Month 13-24 (Year 2) | 25-50% | Monthly vesting kicks in (1/36 per month) | You keep vested %, lose unvested % |

| Month 25-36 (Year 3) | 50-75% | Continued monthly vesting | Same: keep vested, lose unvested |

| Month 37-48 (Year 4) | 75-100% | Final year of monthly vesting | At month 48, fully vested. Keep all |

| Month 49+ | 100% | All vested. No more retention mechanism | Yours forever. Vesting schedule over |

Why 4 Years? Why Not 3 or 5?

- Historical reason: Legacy from pre-401K era when big company pension plans used 5-year vesting. Startups offered 4 years as competitive advantage

- Psychological reason: 4 years feels “forever” to early-stage people. 3 years feels too short. 5 years feels excessive

- Business reason: By year 4, founders/employees have built real momentum. Company is either scaling or pivoting. Good checkpoint for vesting to end

- Market standard reason: Everyone uses 4 years. Deviating makes you look like bad actor. VCs expect 4 years

Why 1-Year Cliff Specifically?

- Retention gate: You MUST stay at least 1 year to get ANY equity. Deters people taking job just for vesting

- Minimum contribution: First year proves you’re serious and building, not just riding equity wave

- Company survival: Early stage is hardest. If you leave in first year, you didn’t earn it

- All-or-nothing cliff: 25% vests at once (not gradually). Creates retention gate. Month 11 departure = 0%. Month 13 departure = keep 25%

Cliff Mechanics: Why Month 12 Matters

The cliff is the most important concept. Month 12 is a massive retention event. Here’s why.

Real Example: Founder Scenario

- Day 1 (Jan 1, 2025): Founder A and B each get 500,000 shares (50% each). 4-year vesting with 1-year cliff

- Month 11 (Nov 30, 2025): Founder B is frustrated. Quits. Vested shares = 0 (still in cliff). Unvested shares = 500,000 (all forfeited). Net result: Founder B walks away with $0 equity

- Month 13 (Feb 1, 2026): Founder A is still here. Cliff passed. Vested shares = 125,000 (25%). Founder A owns these forever now. Remaining 375,000 unvested, but already earned 25%

- Month 24 (Jan 1, 2027): Founder A at 2-year mark. Vested = 250,000 (50%). Company valued ₹50Cr. A’s 50% = ₹25Cr (on paper)

- Month 48 (Jan 1, 2029): Founder A at 4-year mark. Vested = 500,000 (100%). Fully owns their stake

The Cliff Impact (Why It’s Harsh)

- Month 11 departure cost: Zero equity vested. Founder B forfeits 100% of their shares (500K shares worth potentially ₹50L+ on paper). Hard lesson

- Month 13 departure cost: Only 25% vested. Founder B keeps 125K shares (₹12.5L on paper). Loses 375K shares (₹37.5L on paper)

- Motivation to stay: Cliff is “all-or-nothing” gate. You MUST hit month 12 to get anything. Creates retention tension. People clock month 12 and feel relief

Cliff Real-World Impact (From Data)

- Founder leaving before cliff (0-11 months): Lose all equity. About 5-10% of co-founders depart before 12 months (usually poor founder fit detected early)

- Founder leaving after cliff (13-24 months): Keep 25-33% vested. About 10% of co-founders depart in year 2 (usually co-founder conflict)

- Founder leaving post-year 2 (25+ months): Less common. Only ~5% of co-founders depart after year 2. Usually acquisition/pivot-related

Why Cliffs Exist (From Cap Table Perspective)

- Problem without cliff: Co-founder leaves after 6 months. They get 6/48 = 12.5% vested. Cap table bloated with inactive founder holding equity. Hard to recruit new hires (“Who’s this person holding 12.5%?”)

- Solution with cliff: Co-founder leaves after 6 months, get 0%. Cap table clean. New founder comes in fresh. Clean onboarding

- Retention mechanism: Cliff makes vesting “sticky.” You must survive 12 months to get anything. Creates psychological commitment

Founder Vesting: Restricted Stock & 83(b)

Founder vesting is different from employee vesting. Founders get restricted stock with reverse vesting mechanics. Critical tax consequence.

How Founder Vesting Works (Reverse Vesting)

- Day 1: Founders get ALL shares immediately (500,000 shares for each co-founder)

- But they’re “restricted”: Company has repurchase right on unvested shares. If you leave before 4 years, company buys back your unvested shares at ₹1/share (or formula price)

- Example: Founder leaves at month 18 with 50% vested. Company exercises repurchase right, buys back 250K shares at ₹1 each (₹2.5L). Founder keeps 250K vested shares

The 83(b) Election (Critical Tax Matter)

This is crucial. Miss the deadline and face huge tax consequences.

- What it is: IRS form filed within 30 days of receiving restricted stock

- Why it matters: Without 83(b), you pay ordinary income tax on restriction lapse. With 83(b), you pay capital gains tax on future gains

- Example impact: Restricted stock worth ₹10L at grant with no 83(b) = ₹10L ordinary income taxed at 30% = ₹3L tax immediately. With 83(b), you pay capital gains tax later when you sell

- Deadline: 30 days from grant date. HARD DEADLINE. Miss it and you can’t file late. Penalty is massive tax bill

Action Item: File 83(b) Immediately

- When: Get founder agreement → Day 1 of incorporation → File 83(b) within 30 days

- How: Work with tax attorney or CPA. Get template from IRS (Form 83(b))

- Cost: ₹5-10K in tax advisory fees. Worth every rupee

- Documentation: File with IRS + keep copy + submit to company + keep for your records

Founder Vesting Best Practice

- Document in Founders Agreement: Should specify 4-year vesting with 1-year cliff, repurchase rights, what happens on termination, 83(b) filing requirements

- Get legal help: Don’t DIY founder agreements. Use lawyer for ₹25-50K. Protects you from disputes

- All founders same schedule: Even if one founder does more work, equal vesting schedules prevent future conflicts

Employee Vesting: Stock Options & RSUs

Employee vesting is different from founder vesting. Employees get options (right to buy) or RSUs (restricted stock units), not shares directly.

Stock Options (Most Common for Startups)

- What you get: Right to buy shares at strike price (usually set at FMV at grant date)

- Vesting mechanics: 4-year vesting with 1-year cliff. Options vest (become exercisable) on schedule

- Example: Get 10,000 options at ₹500 strike. After 1-year cliff, 2,500 options vest. After 4 years, all 10,000 vested. You can exercise and buy shares at ₹500 each

- Key difference from restricted stock: You don’t own shares until you exercise. Vesting just gives you right to exercise

RSUs (Restricted Stock Units – Tech Companies)

- What you get: Promise of shares on vesting date (not immediate ownership)

- Vesting mechanics: Same 4-year vesting with 1-year cliff

- On vesting date: Company issues actual shares to your account

- Tax event: When RSU vests, you owe income tax on fair market value at vest date (like perquisite income)

- Less common in early-stage startups: Usually used at Series B+ when company is valued at ₹50Cr+

Vesting Schedule for Employees (Standard)

| Company Stage | Typical Vesting | Why This Schedule |

|---|---|---|

| Seed (Hires 1-5) | 4-year / 1-year cliff | Early stage. High risk. Cliff incentivizes commitment |

| Series A (Hires 6-15) | 4-year / 1-year cliff | Standard. Product-market fit achieved. Still high risk |

| Series B+ (Hires 20+) | 4-year / 1-year cliff (or 3-year / 6-month cliff) | Mature company. Sometimes shorten cliff to attract talent |

What Happens to Vesting When You Leave

- Before cliff (0-11 months): Lose all options/RSUs. Forfeited

- After cliff (12+ months): Keep vested options/RSUs, lose unvested. Usually 90 days to exercise vested options

- Fired for cause: Company may have “bad leaver” clause that cancels all vested options. Very rare and controversial

- Laid off without cause: Usually get all vested options + may get extended exercise window (6-12 months instead of 90 days)

Acceleration Clauses: Double-Trigger vs Single-Trigger

Acceleration clauses let unvested equity vest immediately if certain events happen (like company acquisition or employment termination).

Why Acceleration Matters

- Scenario: You’re founder/employee with 50% unvested equity (2 years in). Company gets acquired. New owner lays you off immediately

- Without acceleration: You leave on day 1 of acquisition. Your 50% unvested equity is lost. Massive wealth destruction

- With acceleration: Depending on clause type, unvested equity accelerates (vests early). You keep your equity stake at acquisition

Type 1: Single-Trigger Acceleration

- How it works: Unvested equity vests immediately when ONE event occurs (usually change of control / acquisition)

- Example: Company acquired at ₹500Cr. You have 50% unvested. Automatically vests. You keep your full equity stake through exit

- Founder benefit: Huge. Protects against acquisition layoffs

- Company perspective: Expensive. All founders get instant full vesting on acquisition. Discourages acquisitions if buyer wants founder retention

- Market prevalence: Rare. VCs usually don’t allow (want retention post-acquisition)

Type 2: Double-Trigger Acceleration (More Common)

- How it works: Unvested equity vests only if TWO events occur: (1) change of control AND (2) involuntary termination within 12 months

- Example: Company acquired at ₹500Cr. You keep your job for 6 months. New owner lays you off. Now two triggers met: (1) acquisition happened, (2) you got laid off. Unvested vests

- Founder benefit: Good. Protects against acquisition layoffs but not if you stay

- Company perspective: Balanced. Founder stays post-acquisition = no extra vesting. Founder leaves = gets accelerated vesting. Aligns incentives

- Market prevalence: Standard. 70%+ of acquisition agreements have double-trigger acceleration

Single-Trigger vs Double-Trigger Comparison

| Scenario | Single-Trigger | Double-Trigger | Outcome Difference |

|---|---|---|---|

| Company acquired, you stay 2 years | Unvested vests on day 1 | No acceleration. Vesting continues | Single-trigger: you get acceleration. Double-trigger: you don’t |

| Company acquired, you laid off 3 months later | Unvested vests on acquisition day | Unvested vests on layoff day | Single-trigger: 3-month earlier vesting. Double-trigger: same end result |

| Company acquired, buyer wants you to stay | You’re fully vested immediately. Can leave anytime | You keep vesting schedule. Incentive to stay | Double-trigger: better for buyer (retention). Single-trigger: bad for buyer |

Negotiating Acceleration Clauses

- As founder: Push for single-trigger (best case) or double-trigger with 12-month window (most likely). “We’re taking risk. If acquired, we should get full vesting”

- As investor: Usually resist single-trigger (makes acquisition harder). Accept double-trigger as standard

- In term sheet: Should be specified clearly. “Double-trigger acceleration: 100% of unvested options vest if (1) change of control AND (2) involuntary termination within 12 months”

Bad Leaver Clauses & Forfeiture

Some startup agreements include “bad leaver” clauses that let company forfeit even vested equity in extreme cases.

What’s a Bad Leaver Clause

- Trigger: Employee leaves under “bad” circumstances (fired for cause, violation of non-compete, fraud, etc.)

- Consequence: Company can repurchase vested shares at ₹1/share (or formula price, not fair market value)

- Impact: Employee loses equity value. Usually devastating

Example: Bad Leaver in Action

- Year 2: Employee has 50% vested (50,000 shares out of 100K). Company valued ₹50Cr. Employee’s vested equity worth ₹25L on paper

- Employee fired for cause: Caught stealing code. Bad leaver clause triggered

- Company repurchases: Buys back 50K vested shares at ₹1/share. Employee gets ₹50K. Lost ₹25L of paper wealth

Bad Leaver Clause Red Flags

- Too broad “for cause” definition: Should be specific (fraud, theft, IP violations). NOT generic “violates policies”

- Non-compete violations: Some agreements treat non-compete breach as “bad leaver”. Usually contested. Avoid if possible

- Overly punitive repurchase price: Should be ₹1/share or original strike price, not ₹0

Negotiating Bad Leaver Clauses

- As employee: Negotiate narrow definition of “bad leaver”. Should only include: (1) fraud, (2) criminal activity, (3) IP theft, (4) non-compete breach

- Avoid: Generic “material breach of agreement” or “violation of company policies”

- Repurchase price: Negotiate ₹1/share minimum or original strike price (not ₹0 or penny value)

Negotiating Vesting: What to Push For

Founder Vesting Negotiation Checklist

- Check 1: Vesting schedule. “We want 4-year vesting with 1-year cliff. This is market standard” (non-negotiable)

- Check 2: Cliff amount. “At 1-year cliff, 25% vests (standard). We’re not negotiating this” (non-negotiable)

- Check 3: Acceleration. “We want double-trigger acceleration on acquisition. If we’re laid off post-acquisition within 12 months, 100% vests” (negotiable)

- Check 4: 83(b) filing. “We’ll file 83(b) within 30 days. Company will document this” (non-negotiable for founders with restricted stock)

- Check 5: Repurchase rights. “If we leave, company can repurchase unvested at ₹1/share. Vested shares are ours” (standard)

Employee Vesting Negotiation Checklist

- Check 1: Vesting schedule. “We want 4-year vesting with 1-year cliff” (standard, market expectation)

- Check 2: Cliff length. “Can we negotiate 6-month cliff instead of 12?” (only if company is Series B+ and competitive talent market)

- Check 3: Acceleration. “If company is acquired and I’m laid off, do my vested options accelerate?” (ask about double-trigger)

- Check 4: Exercise window. “If I leave, how long to exercise vested options?” (push for 6-12 months, not 90 days)

- Check 5: Bad leaver clause. “What triggers bad leaver status?” (negotiate narrow definition)

When to Negotiate Differently

- Early stage (Seed), you’re co-founder: Accept 4/1. Non-negotiable. VCs require it

- Series A+, you’re key hire: Can push for 6-month cliff instead of 12-month (rare but possible)

- Series B+, you’re executive: Can negotiate acceleration clauses + extended exercise windows

- You have competitive offers: Leverage them. “Company X offers double-trigger acceleration. Will you match?”

What NOT to Accept

- Vesting schedule >5 years: Red flag. Unusual and punitive

- Cliff >18 months: Uncommon. Only justified at growth stage

- No acceleration on acquisition: At minimum, ask for double-trigger

- Bad leaver clause with undefined “for cause”: Too much company discretion

- Exercise window <90 days: Unrealistic. Push for 180 days minimum

Key Takeaways: Vesting Schedule Mastery

1. Vesting is legal mechanism where you earn equity gradually over time instead of owning all shares day 1. Protects company against early departures.

2. 4-year vesting with 1-year cliff is 100% industry standard (95%+ of startups use it). Anything different raises VC questions.

3. Cliff mechanics: Months 1-12 = 0% vests (cliff period). Month 12 = 25% vests at once. Months 13-48 = remaining 75% vests monthly (1/36 per month). All-or-nothing at month 12.

4. Leave before cliff (month 11): lose 100% of equity. Leave after cliff (month 13): keep 25%, lose 75%. Cliff is harsh but necessary.

5. Founder vesting uses restricted stock (you own shares day 1 but they’re restricted). Employee vesting uses options (you get right to buy) or RSUs (promise of shares on vest date). Different mechanisms.

6. Founder critical action: File 83(b) election within 30 days of receiving restricted stock. Miss deadline = massive tax consequences. Non-negotiable.

7. Acceleration clauses exist: single-trigger (vests on acquisition) vs double-trigger (vests on acquisition + involuntary termination). Double-trigger more common (70%+ of acquisitions).

8. Single-trigger acceleration: if company acquired, you get 100% instant vesting regardless of employment status. Good for founders. Rare (VCs discourage).

9. Double-trigger acceleration: vests only if (1) acquisition AND (2) laid off within 12 months post-acquisition. Balanced incentive. Standard market term.

10. Bad leaver clause: company can repurchase vested shares at ₹1/share if you leave under “bad” circumstances (fraud, IP theft, non-compete breach). Negotiate narrow definition.

11. Typical vesting forfeiture: leave before cliff = lose all unvested. Leave after cliff = lose only unvested shares, keep vested. Vested shares are yours forever once cliff passed.

12. Exercise window after leaving: typically 90 days for vested options to exercise. Negotiate for 180 days if possible (especially if laid off without cause).

13. Founder vesting negotiation: 4/1 schedule non-negotiable, but acceleration clauses ARE negotiable. Push for double-trigger minimum.

14. Employee vesting negotiation: 4/1 is standard. At Series B+, can push for 6-month cliff (rare). Push for acceleration clauses + extended exercise windows.

15. Action: Founders, get founder agreement drafted with 4/1 vesting specified + file 83(b) within 30 days. Employees, review offer letter for vesting schedule + acceleration clauses + exercise window + bad leaver definition.