Complete startup banking guide 2025 India: current account comparison (HDFC ₹50K AQB ₹3K NMC, IDFC FIRST zero AMB first 3 years free cash deposit ₹30L/month, Axis FlexiSave ₹1L minimum), payment gateways (Razorpay 2% + 18% GST domestic, Stripe 2.9% +…

GST Compliance: Registration, Filing, Invoicing (India)

Complete GST compliance guide 2025 India: registration thresholds goods ₹40L (₹20L special states), services ₹20L (₹10L special states), GSTR-1 monthly by 11th, GSTR-3B monthly by 20th, late fees ₹50/day (₹20/day nil returns) capped ₹5000, 18% annual interest on unpaid tax,…

Fundraising Budget: How Much Does Fundraising Really Cost?

Complete fundraising cost breakdown 2025 India: legal fees SAFE ₹30-50K (simplified) vs term sheet ₹50-100K, accountant due diligence ₹15-75K (Seed to Series C), travel ₹2-10L, time cost 3-6 months (14% founder capacity), opportunity cost ₹20-40L+ (lost revenue/growth opportunities). Total Seed…

Cash Flow Management: The #1 Reason Startups Die

Master startup cash flow 2025: 38-44% of startups die from running out of cash (2nd reason after no market need). Runway formula: cash / net burn rate (months). Burn multiple benchmark <1 excellent, 1-1.5 great, 1.5-2 good, 2-3 suspect, >3…

Startup Accounting 101: Basic P&L, Balance Sheet, Cash Flow

Complete startup accounting guide 2025: P&L statement (revenue – COGS – operating expenses = net profit, tracked monthly), balance sheet (assets = liabilities + equity, point-in-time snapshot), cash flow statement (operating/investing/financing activities, tracks actual cash), bookkeeping software costs (Zoho Books…

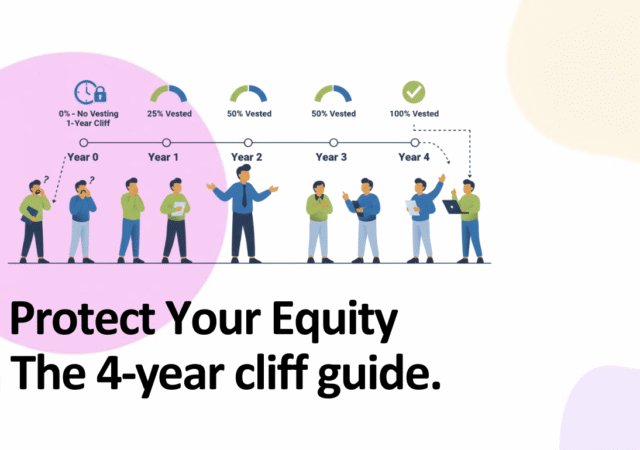

Vesting Schedule Explained: Why 4-Year Cliffs Matter

Complete vesting schedule guide 2025: 4-year vesting with 1-year cliff is 100% industry standard. Cliff mechanics (0% months 1-12, 25% cliff at month 12, then 1/36 monthly), founder leaves before cliff = forfeits all equity, acceleration clauses (double-trigger vs single-trigger),…

Tax Planning for Startup Founders: ESOP, TDS, and ITR Filing

Complete tax planning guide 2025 India: ESOP taxation (no tax at grant, perquisite income at exercise 10-30%+, capital gains 10% LTCG), Section 80-IAC 100% profit exemption 3 years, GST ₹40L goods/₹20L services threshold, TDS Section 195/194, ITR filing (ITR-3/4/5), tax…

Equity Negotiations with Investors: Don’t Get Diluted Too Much

Master founder equity negotiations 2025: maintain 50-60% ownership by Series A through strategic dilution management (20-25% seed, 20% Series A, 15% Series B), negotiate weighted average anti-dilution over full ratchet, secure 1x non-participating liquidation preference, preserve voting control through board…

Cap Table Management: Your Equity Spreadsheet (Template)

Complete cap table management guide 2025: build equity tracking spreadsheet, founder dilution mechanics (100%→41% through Series B + ESOP), shareholder tracking, dilution calculations, scenario modeling, and software comparison (Carta $280/mo, Ledgy €3k/yr, Pulley ₹1200/yr, free options for <25 stakeholders). Table…

Employee Stock Options (ESOP): Complete Guide for Startups

Master startup ESOPs 2025 India: what stock options are, how they work, 4-year vesting with 1-year cliff (standard), taxation (no tax at grant, perquisite income at exercise, 10-12.5% LTCG at sale), pool sizing (10-15%), tax deferral (48 months for eligible…